Know Your VCs: Before You Come to the Pitch Deck

Investors are often recognized as the only source of funding for startups — that’s not true: you can crowdfund or choose a slow organic growth and scaling instead of approaching VCs. Each one of these paths is complicated, and you have to know what you’re getting yourself into before you’re standing at a pitch deck or trying to formulate a message for Kickstarter.

In this article, we’ll help you to better understand venture capital in general and know what questions to ask and what to look at while looking for your perfect VC.

Don’t make venture capital funding your default choice

Maybe it is a result of entrepreneurs being affected by the 2012-2016 boom in the seed funding, which appeared after Facebook has gone public and VCs have started to reinvest.

Maybe, that’s due to choosing the path of the least resistance: get a lot of money and one time and fast.

Media also doesn’t help to keep a cool mind with all this news about new deals and new startups.

What are we talking about? Small startups who consider investments their first choice for funding.

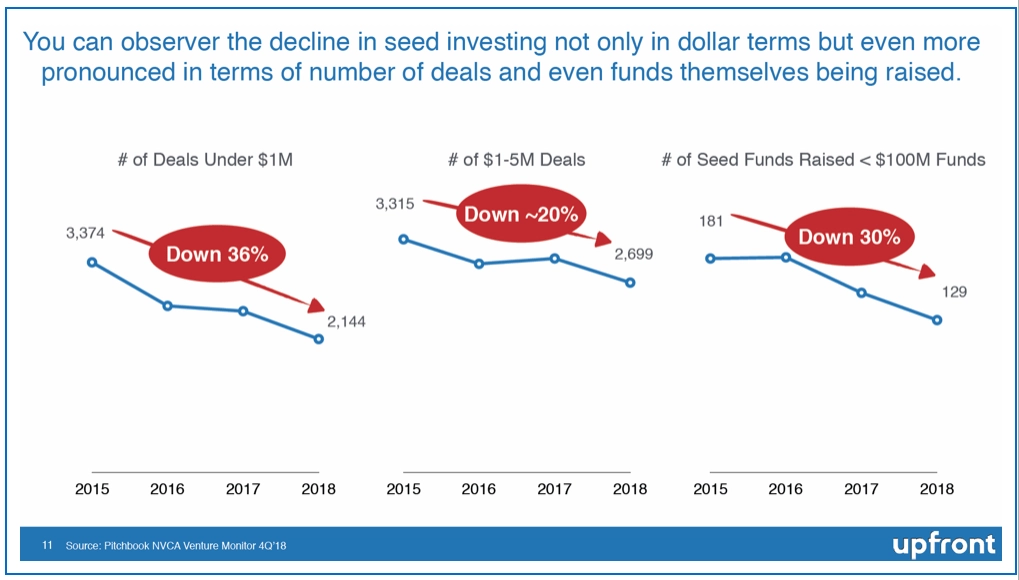

Data on deals in seed and early-stage investing shows a decline in the past few years. It’s become easier to start a company due to… cloud. The quality of new businesses, though, didn’t improve due to the new technology — they just started to appear faster.

According to PitchBook & NVCA Venture Monitor, VCs have invested $32.6 billion in the first quarter of 2019. While it’s the highest sum of the last decade — second only to last year’s Q4 results — these billions cover only 1862 deals; and that’s the lowest number of deals financed since the 2011 year.

Mostly, these $32.6 billion were given to businesses that are already scaled and developed.

If we’re talking in black and white, VCs are actually better for startups on the stage of growth: companies like Uber, for instance, required investments on the late stage of development to boost their growth.

There are actually very few small founders and business models that fit into investors’ financial interests. These are the companies that have potential, business model and team that is dedicated to rapid hyperscale that will lead to acquisition or IPO, giving VCs large exits.

An absolutely possible situation: A company gets an acquisition offer, it’s possible for founders to stay with lesser money if VCs were involved than if they’d use profit money to grow organically.

Case in point: Don’t make VCs your first choice and carefully consider the math behind the rounds. Be frank with yourself and don’t use “I need more money now” motivation to make “to be or not to be” decision.

Choose VC who will add value to your relationship

Now, you've decided you’re building a rocket — and you want that rocket fuel. Now it’s time to know more about people you’re going to work with for years. Otherwise, you might get a mild version of Game of Thrones sequence: we can’t do this, that and that — why? — because our VC said so. https://twitter.com/hugs/statu...

So, how to find a perfect candidate?

#1. Research. It’s never enough research.

People often write that all entrepreneurs and startups are different, but all venture capitalists are more or less the same: they want their exit or their seat on board and their exit — and as fewer risks as possible, with no reputational risks.

That’s a generalization. Investors are people: risk aversion or not, they are all different — and even while they are really less differentiated than startups, it’s still possible to see segments. Upfront, for instance, proposes the following segments: https://bothsidesofthetable.co..

- Seed Capital Investors — take the start and help startups build the initial product. They are willing to take a risk — that’s why they choose small ownership.

- Traditional Venture Capital Investors — help startups scale. They’re taking board seats, help in hiring and culture matters, help startups get recognized and meet experts.

- Growth Capital Investors — account for 62% of the entire market. Invest in pre-IPO or pre-acquisition startups and help founders be in the state of “private IPO” (when a company can go public but doesn’t do it to increase its own value). Have ownership and pro-rata rights.

Clearly, if you’re a young startup your choice is to dive in into seed and early-stage investors. Luckily for everyone, venture capital market stopped to be a dark and mysterious place where the money reside and start being a more or less open community: VC firms are blogging on Medium and are present on LinkedIn. On the latter, they usually specify their segment in their profile.

That’s where your true research and establishing relationship stage begins.

We’ve talked about how it’s better to do customer research first and look for VCs later. In your quest in finding good, supporting VC who’ll actually add value to your team and business processes, you’ll need to use your customer research skills:

- Get to know if your product is promising for the VC industry if such is specified. Be honest with yourself and don’t stretch your reasoning.

- Know what language they speak and what human values they uphold. Mean people are exhausting.

- Get familiar with their portfolio. See if they’re explaining why they invest in this or that startup — it may shed light on their motivation and expectation.

- Check out startups in their portfolio: how they’ve been growing, what is the state of their brand. Talk to them. Ask for references.

#2. Initiate early contact and become visible

Then, get in contact. It’s not pitching yet — it’s establishing a bond. An early date.

Don’t hide the fact you’re from the startup and you might look for funding soon.

Extend your content strategy to articles on LinkedIn. (Yeah, big news: Investors see the great importance in the brand of the partner, so them seeing you execute open, fun, and informal communication strategy may add you some bonuses. As we said, if you know your customers’ needs and know how to talk to them, you’re a prospective candidate for financing.)

Comment on VC’s content. Ask questions about their industry, new deals, news. Interact. Ask them for their opinions on your product or services. Set up short meetings, coffees, or calls.

Why do you need to do that, to be visible for your future VCs and to establish communication months before you’ll jump to pitching?

Here’s what Mark Suster, an entrepreneur earlier and VC now, writes about it: “The first time I meet you, you are a single data point. A dot. I have no reference point from which to judge whether you were higher on the y-axis 3 months ago or lower. Because I have no observation points from the past, I have no sense for where you will be in the future. Thus, it is very hard to make a commitment to fund you.”

If you are a line of impressions, though, that changes. They will see your performance, your ups and downs, and instead of relying on traction, described to them in an elevator pitch, they’ll make a decision considering long-term observations of your performance.

Note, that it’s not only for investors. As Suster writes in his points, VCs do invest in “dots”, but you are also taking the money and giving ownership to dots. That can be risky.

#3. Don’t be afraid to ask too many questions

Often, founders are so willing to skip to the “pls give me the money” part that they forget one essential thing: it’s going to be a partnership. You need to like the person who’ll invest in you, resonate with him or her, have the same views on how business should be built. So — ask questions (that were not answered before with VC’s content).

Questions to consider:

- How long have they been in the venture business? How did they switch to it? Why ventures?

- What is their target market? Are they focusing on any specific sector? Why?

- What are their expectations from startups?

- How do they prefer to work with portfolio companies? (It’s better to specify which case is of interest to you)

- Who are their limited partners (LP)?*

- Etc., etc, etc, — all curiosity you need to satisfy

#4. *Know LPs behind VCs of your dream

Now, a bit about limited partners (LP): it’s better to research them too. These are the people your VCs are getting money from — so you absolutely have to know who are these people.

General in-between-note: Your startup will benefit from constructive dialogue from people you work with. That works in any interaction.

So, limited partners. Along with a fact they’re giving money to your investor who’s giving them to you and, occasionally, sitting on your board meeting and even helps you to be better, faster and cooler, they are, themselves can add value. You just need to know if they’re willing — acknowledge them (through VCs).

Some of the points:

- They’re a lot more experienced than VCs, usually. They built big things and failed, as all people who’re doing something for a long time, a lot. So LP is one of the best sources of new, multi-angles perspectives on how to deal with things (especially in times of crisis.)

- They’re people who know people. A lot of people. Business introductions are vital for startups, and LPs are just what you need to get them. (Are we the only one who hate the word “networking”?)

- They can lead your investment rounds. Because they’re experienced & know people & know finance & interested in making it work.

Bottom line: if you’re going to depend on someone, get to know them. VCs and LPs are interconnected, so get to know both. The methods for LPs are all the same.

Final point: relationship with non-superheroes

Don’t treat VCs as gods or messiahs. They don’t have all the answers to questions for your industry. They make mistakes. And they actually shouldn’t tell you how to run your business — it’s your business, you’re a star here.

They might help you to get industry insights, see market opportunities, help hire people, etc., but when it comes to influence or operational support — well, investors tend to overestimate the significance of their input in that. Real talk: according to this study, VCs score their influence 32% higher than entrepreneurs score their own VCs. https://hackernoon.com/do-vcs-...

VCs use their connections in the business world to get experts on your board who’ll help you to deal with your challenges. Their power is in their network and their selling skills.

You figure out how to grow and scale your software development for startup together. Both founders and VCs in the abovementioned study considered personal chemistry the most important factor in the partnership. It’s safe to say that while you’re trying to become a line at the beginning — VCs are trying to gain the trust of your team, friends, and advisors when initiating the deal.

And together, you build that brilliant business, yeah? Make this relationship equal and valuable for your business. Choose carefully.

And remember: You cannot overcommunicate.

Tell us about your project

Fill out the form or contact us

Tell us about your project

Thank you

Your submission is received and we will contact you soon

Follow us