Who raised the most among digital health startups in 2019?

- 1. Verily, the USA, San Francisco: health data science platform

- 2. JD Health from Beijing, China: e-commerce platform for pharmaceuticals

- 3. Bright Health, Minneapolis, United States: direct-to-consumer insurance

- 4. Babylon Health, England, London, AI symptom-checker and other solutions

- 5. Clover Health, the USA, Jersey City: network-neutral direct-to-customer insurance

- 6. Lenskart, India, Faridabad: online store for eyewear

- 7. CMR Surgical, England, Cambridge: a robot for surgeons

- 8. PharmEasy, India, Mumbai: an online delivery platform for meds and other care products

- 9. Taimei Technology, China, Jiaxing: cloud solutions for clinical trials

- 10. Collective Health, the USA, San Francisco: digital health insurance tool for employers

- Final thoughts - digital health startups in 2019

In 2019, worldwide digital health industry funding reached $13.7 billion, and it was the second-largest funding year for the industry. We chose ten most-funded digital health startups from 2019 and tried to figure out why they raised so much.

1. Verily, the USA, San Francisco: health data science platform

First in our list, Verily, an American startup that helps organizations “collect, organize, and activate health data”, raised $1 billion in 2019 from a private equity round. Verily is Google’s Alphabet’s life sciences branch, and it’s the first company raising this much last year.

During 2019, Verily received FDA clearance for its Verily Study Watch, an on-demand ECG wearable for investigational use. Thanks to partnerships, formed with pharmaceutical companies (Pfister and Novartis, to name a few), they started to apply the device in various clinical research projects, to bring the more accurate and engaging experience for participants of clinical trials.

Verily’s Project Baseline, a platform for participation in clinical studies, launched Moon Study (to figure out digital markers of depression), partnered with Color to show people their genetics information, partnered with iRhythm (to create screening tools for patients with atrial fibrillation, started using its ML algorithm for diabetes in clinical settings, etc, etc.)

In one word, their scope of activity is huge. The most amazing value they bring to the healthcare market is making clinical studies more diverse, understandable, even enjoyable for its participants — and, of course, advancing knowledge about people’s health and illnesses through research, utilizing the powers of data science. Which is quite a reason for investors (along with, you know, Google).

2. JD Health from Beijing, China: e-commerce platform for pharmaceuticals

JD health is a healthcare “spin-off” of one of China's largest e-commerce platforms, JD.com. The startup, just as Verily, got $1 billion in Series A from CPEChina Fund, CICC Capital, and Baring Private Equity Asia, becoming the third unicorn amidst other units of JD’s: JD Logistics (supply chain management and transportation) and JD Digital (data technology, smart devices, AI).

In 2018, JD already had more than half a thousand warehouses across China, and its workers managed the majority of deliveries within a day after purchase. Before the healthcare branch spun off, the conglomerate partnered with medical logistics companies and introduced insurance shopping service in its JD Finance. PR “dark times” experienced by JD in 2018-2019 have faded with Richard Liu, CEO of the company who was accused of rape which damaged the company’s image, stepping down from the several key positions.

Apart from that, in 2018 China’s State Council government urged hospitals and provider organizations partner with software companies, and last year’s Pharmaceutical Administration Law finally officially permitted pharmacies to sell prescription drugs online (before that, the law was rather vague on the subject.) Which also made things easier for JD Health.

In the summer of 2019, JD Health became the largest third-party platform for wholesale drug purchase. Xin Lijun, the CEO of JD Health, told South China Morning Post that the company is already profitable. Apart from retailer functions, JD health connects local public med insurance companies to online pharmacies and offers medical IT services for providers.

Basically, the main reasons for amazing results in valuation (~$7 billion) will be the age of the company and its well-worn and reliable, very quick supply chain. JD already had trust — being a giant — and interest in the healthcare sector: they started investments in digital healthcare in 2013.

Multiple partnerships with hospitals, pharmacies, and insurers, Xie Lijn believes, also played a huge role in such growth. They were supposedly formed so quickly due to JD Health’s place in Chinese’s business and the company's promise of availability and accessibility in healthcare.

3. Bright Health, Minneapolis, United States: direct-to-consumer insurance

Bright Health is a health insurance company that provides direct-to-consumer insurance and connects people to partnering physicians and healthcare services providers. The company gained $635M in series D, which was led by New Enterprise Associates.

In 2019, Bright Health joined other digital health insurers who started selling Medicare Advantage plans, providing people with additional benefits for seniors, individuals with chronic diseases, etc. The company grows quickly: established in 2012, they increased the coverage to 12 states and 22 different markets in them. In 2020, they plan to add 13 more states under the wings.

Bright Health collaborates with providers of different specialities and local communities, building a care network which focuses on prevention and prioritizing, on one hand. On the other hand, Bright Health proactively communicates with its members, helping them manage high-risk illnesses and chronic conditions. Such a system allows end-customers to manage their health through coordinated care with different specialists and reduce out-of-pocket expenses and provides physicians with an opportunity to reduce readmissions and ED visits.

Reasons for Bright Health popularity among investors are simple: the market need for affordable and understandable insurance solutions with no “man in the middle”, playing with costs of care services, is very high.

4. Babylon Health, England, London, AI symptom-checker and other solutions

Babylon Health raised $500M in last year’s Series C with Saudi Arabia’s Public Investment Fund as a lead investor. It’s British AI-based health services startup that achieves amazing results in healthcare and plans, heavily, to continue advancing NHS’ and private clinics' services.

Its main solution is an AI-based app that helps patients to find out what their symptoms mean and how they can address them. Babylon Health partners with NHS, England’s national health provider, who use their scheduling and telemedicine app.

Its latest step was a decade-long deal with Wolverhampton, England: Babylon Health plans to provide full health coverage to the entire population of the city — 300.000 people — via a new app.

The startup operates on a large user base: 4 thousand consultations every day or interaction with a patient every ten seconds. However, they don’t want to stop scaling, planning to combine both hospital care and primary care in their next app. They also plan to launch in the USA in 2020.

We’ve watched Babylon Health and its chatbot for a few years already, and it’s wonderful to see how from scrutiny, doubts, and scepticism that surrounded a chatbot three years ago, Babylon grew to a nation-wide provider of high-quality healthcare, affordable and accessible, and proved AI can help doctors.

Their app answered few demands: a demand for quick conclusions/consultations for bothered with health patients; a demand for lower hospital admissions and emergency visits; a demand for control and health management. We invite you to read the reviews (take note on how people from customer service react to the negative ones) and, well, be just as cool and confident.

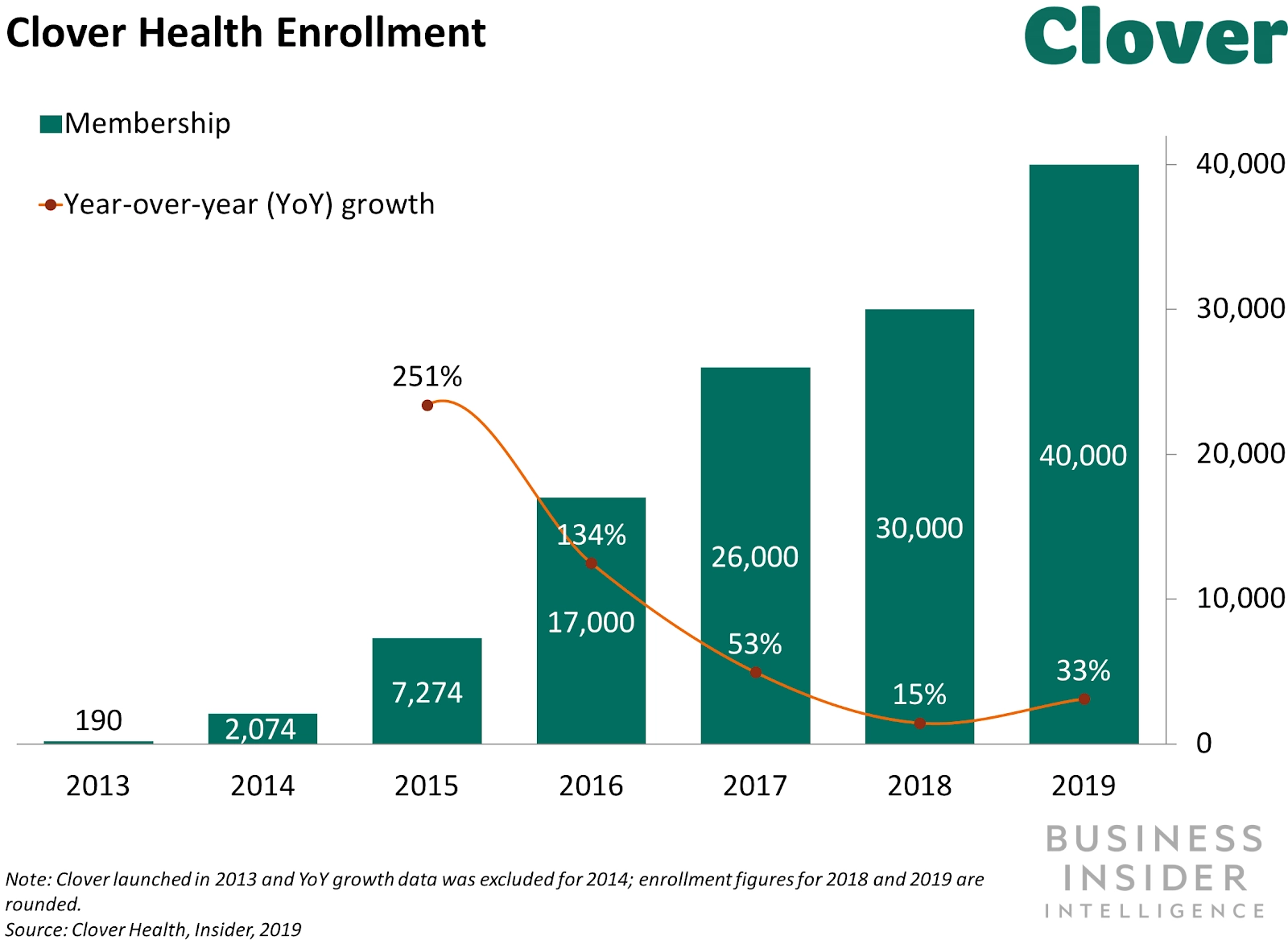

5. Clover Health, the USA, Jersey City: network-neutral direct-to-customer insurance

Cloverhealth is another largely-founded insurance startup. In 2019, they received $500M of funding in Series E, led by Greenoaks Capital.

In spring of 2019, the company changed its structure, recruiting more people with expertise in the insurance and Medicare Advantage market. It's one of the oldest insurance startups at the Medicare Advantage space, and, just like its competitors, they offer benefits to ACA’s plans and convey them through a comfortable consumer-facing technology.

What’s different in Clover, though, is that they don’t focus on covering only in-network healthcare services and providers. They charge the same amount of fee for out-of-network organizations as well. Due to that, people who buy Clover’s plans don’t have to find new doctors in order to fit into plans.

The reason for large funding rounds is pretty similar to Bright Health’s, with an addition of the fact Clover is not a young company. Plus, there’s a matter of expanded value proposition that is comfortable for local markets where few providers operate.

6. Lenskart, India, Faridabad: online store for eyewear

Lenskart is a pioneer of online optical stores in India. They manufacture and sell affordable specs with prescription lenses. People can see how the frames will look on them in 3D AI-empowered model in the app. They can also send the specs back to Lenskart within 14 days and get a refund and get a year (a year!) of warranty. That’s very cool, and investors know that: so Lenskart received $275M in Series G, The round was led by SoftBank Vision Fund.

The value proposition is obvious: people all over the world struggle with vision impairments, and in India, that’s more than half a billion individuals. Yet, only 170 million from that number get their treatment.

Lenskart managed to figure out the prospects for growth in India’s small towns and villages and started offering inspection tests with instructions free of charge. That, combined with affordability and engaging features on the platform, worked well.

7. CMR Surgical, England, Cambridge: a robot for surgeons

British CMR Surgical develops The Versius — a robotic system that is CE-marked and cleared to use across Europe. A robotic system is called “21st-century laparoscopy”: it allows surgeons to work via robots’ precise and mobile “wrists” that are equipped with high definition 3D cameras. A workplace station, ergonomic and beneficial for surgeons' focus, is included in the set.

The solution is pretty portable, so it can be utilized across different places in a hospital without majorly disrupting existing workflow. Also, CMR Surgical offers different ways of payment for the system, including subscription-based model: you buy a managed-service model and pay for it a fixed sum monthly. That’s certainly a new thing for the market, and it is good news for affordability.

We know that robots are already widely used in hospitals, despite the fact it’s not always safe, especially for laparoscopy. No wonder! They are quick, portable, and they’re huge helpers. Investors are pretty fond too: CMR Surgical’s Series C round in 2019 gained them $240M with LGT group as a lead investor.

8. PharmEasy, India, Mumbai: an online delivery platform for meds and other care products

PharmEasy is another startup from India, this time from Mumbai. It’s one of the largest pharma aggregators in the country: the platform connects people to local pharmacies and diagnostic centres. PharmEasy raised 220M in Series D in 2019, and the round was led by Temasek Holdings.

In its core, PharmEasy is JD Health, but it’s in India and it doesn’t have a parent company.

Through PharmEasy’s app, people can order meds or other health products, order med equipment, diagnostic tests, or book consultation with doctors. They also offer to do monthly refills (without a reminder, obviously.) Doctors, on the other hand, use the platform to consult patients and prescribe medications, and pharmaceutical companies use it to close feedback loop and improve their medications.

The startup managed to achieve more than 300% growth in a year, all thanks to tapping into cities and villages that were struggling with access to proper medication and care services before.

9. Taimei Technology, China, Jiaxing: cloud solutions for clinical trials

Taimei Technology raised $354.1M in Series D and Series D+ in 2019. They develop cloud-based products for clinical research and pharma companies.

In general, they have six types of products: among them, solutions for logistics, pharmacovigilance, imaging, trial management. Their TrialOS platform combines 20+ tools for various programmes such as data collection and management, quality control, options for participant recruitment, etc. Product for Clinical Trial management utilizes real-time data flow to enhance and optimize trial operations. Taimei Technology’s goal is to create a seamless R&D process for drug development and clinical trials and unite data and operation across the healthcare supply chain.

An interesting characteristic of the life sciences field all over the world is that while companies in the industry are kind of very interested in digitalization and pushing the whole machine to the bright new digital future, few of them actually manage to perform digital transformation. That said, those who manage to accelerate the process — in a comfortable way for all participants — receive high investments. Apart from that, regulatory landscape relating to drugs in China — as we’ve already mentioned — evolves rapidly, which makes Taimei Technology software for agile pharmacovigilance a quiet valuable vendor as well.

10. Collective Health, the USA, San Francisco: digital health insurance tool for employers

Ironically, the last startup in our list is also an insurance startup, and it’s also from America. Collective Health that allows employers to create and administer care plans, control costs of them and take care of their employees’ health in one platform. Most people in America use employer-provided insurance, so it’s only fair for an innovative platform in that field to receive a lot of funds.

Collective Health provides employers with a possibility to identify their employees’ care needs through ML algorithm called CH Cortex and guides them to providers and partners they need. The platform educates employers on healthcare cost landscape: why prices are changing if they are; what partner can fix that; what services became more expensive. In such a way, employers can support their workers very efficiently, giving them care coverage they really need and establishing a healthier workplace.

Final thoughts - digital health startups in 2019

As you can see, startups in each country we’ve described kinda meet the requirements of these countries’ markets — and, partially due to that, receive money from investors.

Each insurance startup in the USA is an answer to a weak and extremely expensive healthcare system: startupers are trying to make it easier for the patients. China and India tap into increasing access and lowering the price of medication and medical services. The United Kingdom fights for cost-efficiency and rest, both for doctors and patients.

Investments in advanced technologies such as AI, machine learning, robotics (in all its various forms) and blockchain are also much higher than average in healthcare. Plus, there’s a point of life sciences companies which also often receive higher funding than consumer-facing technologies.

You might have noticed we’ve excluded some biotech companies from the list because it was unclear which exactly digital technologies they use. These are FerGene, Sanfer, Vir Biotechnology, BioNTech, BridgeBio, Ginkgo Bioworks, Nuvation Bio, Thyas Co. Ltd, and Asklepios BioPharmaceutical. We also excluded provider organizations that received investments for their innovation, hard work, and amazing quality of care: Radiology Partners, Metro Pacific Hospital, Cleveland Clinic and Tencent DoctorWork. You might wanna look them up.

Surely, the majority of the listed companies have been around for a rather long time and spent resources to gain popularity and trust of investors. But all of them started somewhere and achieved success through demonstrating value. Even subsidiaries of large conglomerates may die if they miss their audience. We think this list is pretty inspiring.

We based this article on data from Crunchbase. We also have an article about the most promising young startups in 2020, also in the digital health field.

Subscribe to our newsletter to receive articles about digital health and related fields and take a look at our YouTube channel.

Tell us about your project

Fill out the form or contact us

Tell us about your project

Thank you

Your submission is received and we will contact you soon

Follow us