How Stripe Integration Helps Startups Simplify Payments

- International support helps to reach target markets overseas

- Payment integration aligns with your business model (with how exactly you want to receive money)

- Stripe makes interaction with customers less complex and more meaningful

- Physical and virtual cards for customers or employees

- Fraud detection through machine learning (ML)

- Fast integration: How Stripe won developers’ hearts

- Final word

Technology that allows retailers to accept credit cards in one click was expected to become as disrupting as Amazon’s and Apple’s payment systems — and it did.

After nine years of life, the company covers 135 countries and provides services to Amazon, Shopify, Kickstarter, Salesforce, and so many others. They managed to collaborate with Apple and, in 2019, got a valuation of $22.5 billion.

Media were calling Stripe “payment juggernaut”. Seems fair so far.

Like most of the good initiatives, Stripe started with a problem.

In 2010, Patric and John Collision noticed that it was very simple to start an online business — but only if there weren’t any online-payments.

Online retailers had to deal with large players like eBay and PayPal. Which were hard to work with both for businesses (due to time, wasted on integration and not automated processes), and for developers (back in 2011 tech companies weren’t very fond of docs, libraries, and interoperability, so it was really dull for tech people).

Brother Collision started Stripe to make online payments easier to build for developers, and, therefore, easier to adopt — for merchants.

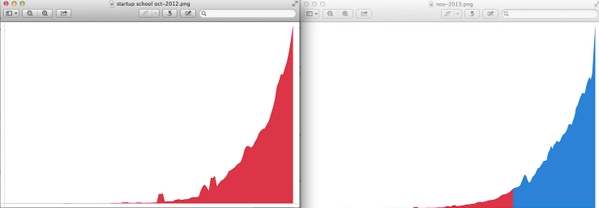

And they’ve totally nailed it — even in first few years, Stripe has grown dramatically. Take a look on the chart.

So, how exactly did they manage it?

Any businesses that require money transfers can get it through Stripe services really fast.

That’s the first and the main one. “Fast” is vital for you — whether you’re a startup, or you want to sell art, or you want to try conquering e-commerce, you will need the following Stripe's features.

International support helps to reach target markets overseas

B2B’s selling points are usually all about how technology N will help you make more money. And it’s true for Stripe. Stripe collaborates with bank transferring systems and other payments technologies to help businesses grow and scale and reach their customers all over the world.

For instance, one of Stripe’s clients is Kickstarter. Funding platform uses Stripe to accept European payments within SEPA (Single Euro Payments Area), an initiative that makes bank transactions in euro simpler for 36 European states. What does it mean for Kickstarter target market? People in countries that use SEPA can back Kickstarter projects. If it wasn’t for Stripe, Kickstarter would have to build SEPA support in-house. Most businesses would reject that approach because it requires them to spend a lot of time to learn all SEPA-related regulations and rules. Thus, the part of their audience that uses SEPA would stay unacknowledged.

Stripe does all learning for them and provides a ready-to-use solution for more and more payment systems, including localized ones, all over the world. So, if you’re planning to scale globally — or to start doing that — consider that option. Also, unlike Paypal’s, Stripe rules for fees in different countries are more unified.

Payment integration aligns with your business model (with how exactly you want to receive money)

As we’ve already said, Stripe services can support any payment method you’ve chosen — it could be recurring transactions, subscription-based payments, credit and debit cards.

The company’s customized services, for instance, became a good choice for Lyft. Lyft allows their driver to send earnings on their debit cards right after their shift ends. That approach drives employee satisfaction: they can get their money without waiting for traditional bank transaction — unlike approach Uber uses, who, by the way, has its own payment technology that still doesn’t support hands-on transfers. With Stripe’s developer tools that allow connecting banks and companies, quick payments become possible — and did a really great job for Lyft’s internal culture.

At the same time, billing plans can be as specific as you like: they can change, depending on the usage, and, for instance, include free trials.

Stripe makes interaction with customers less complex and more meaningful

Stripe, as Pieter Collins once said, removed needless complexity that “gets in the way of the relationship between the customer and the business.”

Users won’t leave your page to pay somewhere else

That means a huge deal both for customer service and for user experience on businesses’ digital platform. Bottom line is that now there’s one interface: business’ interface. No need for users to go to the special resource of the online payment system, that usually has a different interface and requires them to get used to it again (after they’ve just become comfortable with how your site looks). Also, no intermediaries mean no one — except you — connects to your customer.

Users (and you) won’t have to think about currency exchange

The Stripe feature called Connect was developed specifically for different marketplaces support 135+ currencies: again, no need to think about how to convert your and user’s money. Also, no one leaves your site (again.)

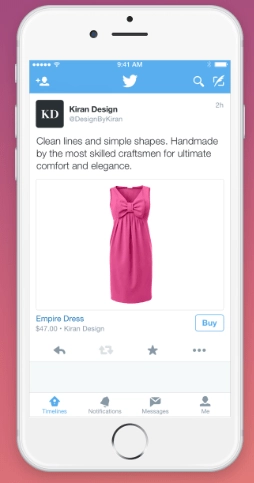

Users can pay through mobile apps

The feature Relay was introduced as a solution to dull purchasing processes in retail, which look really bad for end-user and are extremely complicated to build for retailers themselves— they don’t have (and shouldn’t, actually) necessary programming experience. So Relay is an API (Application programming interface) that enable stores to put their products online and online apps — like Twitter. Products now become visible and easily accessible in the growing number of apps like Spring — but, as far as we know, now Relay is working in the US only.

Physical and virtual cards for customers or employees

Stripe’s internal platform Issuing allows to create, distribute, and manage physical and virtual cards. It can be implemented within seconds, it’s, of course, compliant with most of the card networks. Physical cards can be designed specifically for your business — loyalty “premium” cards, etc. — and delivered within few days, and virtual cards are, as Stripe itself says, good for employee expenses.

Fraud detection through machine learning (ML)

Fraud harms e-commerce and not only by damaging reputation via stealing money from their users, but also via making businesses address this issue with rather unreliable analytical tools that preventively block users that have done nothing wrong in their lives, ever. Which is also not so good for the public image.

Stripe Radar is a suite of tools to detect and prevent fraud in e-commerce. That system is doing everything by itself and protects both businesses and their customers.

A dataset which was used as a training field for Radar’s machine learning algorithms is Stripe’s own dataset from their customer and end-user base. Michael Manapat, ML expert there, says: “When a business using Stripe sees a card for the first time, there’s an 80% chance that we’ve seen the card elsewhere on the Stripe network in the past. Previous encounters with a card offer a significant amount of data to inform our risk assessments.” Data about bank disputes — which occur when, for instance, a user’s credit card was used by fraud, and he or she notices it and addresses bank — is transferred to Stripe via its financial partners. Radar incorporates the main traits of them and protects Stripe’s users without them having to learn how to identify fraud through ML themselves.

Fast integration: How Stripe won developers’ hearts

As we’ve already said, this company was solving two problems: dull business—customer interaction within online payments paradigm and loads of pain and hate developer community were firing at Paypal… First, as you can see, is pretty much solved — so let’s talk about the second.

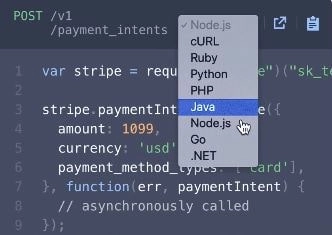

Stripe’s APIs were Christmas, New Year, and Birthday at one day for developers in e-commerce back when they’ve been introduced. They made programming much easier, faster, and comfortable. Some of the developers even wanted to have babies with those APIs. PayPal, instead of wanting babies, was forced to introduce their own APIs — because it seemed that no one would consider no-API payment integration after Stripe. We ourselves used it to tie a customized subscription plan to the descriptive analytical engine and the whole process was fast and comfortable for the team.

Note: An API is a connectivity tool, some kind of a “messenger” that goes to a system (for a bank, for instance) with your request (“pay money for this comic book”) and returns back to you (to the comic shop app) with that request (money). There’s, therefore, no need to open the bank’s app and send your money to a shop. Alternative example: you want to sell your art on Twitter. Stripe offers you to use Relay. Through a few lines of code — Relay APIs — you make your marketplace “visible” for Twitter, and Twitter’s API becomes “fitting” for you to place there your products.

At the same time, Stripe’s libraries supported the most used programming languages — so basically any developer could integrate and translate API into their code base automatically and seamlessly.

All these wonderful, quick-to-use APIs that made businesses make money faster become adored by developers first. They were not only very cool from the programming point of view, but they also had (and still have) extremely clear documentation on how to use all that. Even not technical specialists who managed the payment integration get familiar with a system pretty fast.

Customer’s card data is not in your system

One of the main first features of Stripe was Stripe.js. As they write on their documentation, these are APIs that tokenizes customer info, including sensitive card data through PCI-compliant components and accept payments through browser APIs (like in Apple Pay) and Payment Request API (Stripe’s feature). Bottom line is that users’ private financial data isn’t stored on your servers. Which means, a) you are PCI-compliant because there’s no sensitive data on your site, b) if you’re hacked or have other issues with server’s security, there’s literally nothing of your users’ to steal. Which is good security that is, as we’ve already said, extremely easy to implement.

Final word

We haven’t described all features that are provided by Stripe — for instance, Slack notifying when you get a new customer and Dashboard which allows you to see when and how users pay. The community has good 24/7 customer support and our developers are really happy and productive in working with it.

Of course, there are some uncomfortable things with Stripe. If you have absolutely no experience in working with programming languages, it might take a bit of a time to figure everything out — and if you want to unleash all connectivity power of the platform and have a not a lot of time, we’re advising you to hire at least one developer who can help you with it. Also, all new shiny things first appear in the USA, and countries that are not Australia or the USA have longer money transfers to businesses (two vs. seven days).

But as a hub who helps startups software development and find joy in using utility tools fast, we think Stripe offers wonderful products, and its documentation and community are free from dull long sentences (as that one), rigidity, and low attention to engineers’ needs.

Tell us about your project

Fill out the form or contact us

Tell us about your project

Thank you

Your submission is received and we will contact you soon

Follow us