Trends and predictions for digital health in 2020

Things in the healthcare industry changed dramatically — compared with what was in place a decade ago.

Right now, EHR got better, almost half of the healthcare stakeholders invest in AI software, more and more organizations are already building consumer-centric, patient-empowering processes. On the less bright side, there are still issues: of data leaks and cyberattacks, of no-evidence startups gaining traction, and faxes, faxes are not going anywhere... etc, etc. So, what trends are waiting for digital healthcare in 2020 — and what most curious predictions we can offer for startupers in the field?

Let's look into it.

Digital healthcare funding and deals: What to expect in 2020

In 2019 (at least, in the first three-quarters of it) six healthcare companies (Livongo, Health Catalyst, Change Healthcare, Phreesia, Peloton Interactive, and Progyny) went public. These startups are working with chronic conditions, promoting data analytics- and behavioural-driven value-based care, accessibility, cost-effectiveness and optimization.

Although IPO exits are not a preferable strategy for digital healthcare startups, their number is predicted to increase in 2020. The number of unicorns is rising, and the public often questions investors' sanity in the matter of digital health. Not unreasonable: with about $5 billion invested in the industry startups this year, we keep getting into a trap of products not being adapted for patients. But investors love digital health nevertheless and will continue to fund them heavily; no disruptions and changes happen without risks.

The most heated areas of the industry for them this year are behavioural health products and products for women's health, and this trend will continue to grow (and maybe "women's health" will stop being a niche...who knows.) Also, telemedicine, health sensors and AI-driven solutions for hospitals are among current and future trends in digital healthcare: investors understand end-customers' thrive for accessibility and providers' frustration about routine and inefficiencies.

Now, about deals. Only during the last seven days, healthcare faced at least one merge (between InSight Telepsychiatry and Regroup Telehealth) that aims at the development of largest America-based telepsychiatry services; and, at least one acquisition: VirTrial plans to "adopt" SnapMD — they will be simplifying digital trial process through simplistic and comfy decentralized virtual care platform. 40% of healthcare executives say they likely to “acquire, partner, or collaborate” across the industry in 2020. M&As are what digital health businesses prefer in terms of exists: one of the primary goals is to deliver more value to their consumers through collaboration — at least, for providers. For health plans, the priority is to stay competitive, and for pharma companies and life sciences businesses the main motivation to pursue a deal will be access to new markets (which pretty much what was performed in the example above.)

It’s important to note, though, that while business part of the equation remains more or less optimistic about deals, patients aren’t so hyped. Consumers don’t think business collaboration will benefit them — and it will be businesses’ task for 2020 to understand how to create and communicate the value they’re developing better, and create truly helpful and cost-effective products and services for people.

1. More solutions for healthcare price transparency will appear

First among digital healthcare trends will be transparent, open communication about the cost of health services. According to Ben Isgur who released PwC report on Top health industry issues of 2019 a year ago, 2020 might be a year for "health policy to continue the conversation on price transparency, surprise and balance billing, and drug pricing.

At the same time, price is the primary driver of healthcare spendings' growth and cost trend is expected to increase in 2020 (especially drug spending.) As consumer economics in healthcare will expand — we’ll talk about this trend later, but it’s basically viewing healthcare services as products in a supermarket, — people’s preference will start falling onto providers and vendors that are open about how much they charge and for what.

This December, Trump administration even required hospitals to list their fees online (which hasn’t been great for some of the providers, but still). Some of the American healthcare providers are already shifting towards more open communication: Recondo offered University Health a self-service calculator for services which is placed on the website. Seemingly simple, this solution was an absolute innovation for the hospital. (Insert programmers’ joke about calculator here.)

If open about healthcare costs, providers can expect their pre-scheduling payments to jump: surely, when patients understand what they’re paying for, they’re more willing to pay for it. According to University Health’s experience, there is also a large probability of reducing no-show rate: when patients know how much exactly something costs, they’re not afraid hospital visit will drain their pocket.

2. Value of social determinants of health for providers and startups will increase

You probably know that at least half of healthcare spending occurs not in hospitals, but in people’s homes: 50% of these expenses are thrown into treating chronic conditions, mental health and other rare and complex conditions. Now, according to the World Health Organization, social determinants of health (SDOH) are conditions where “people are born, grow, live, work, and age.”

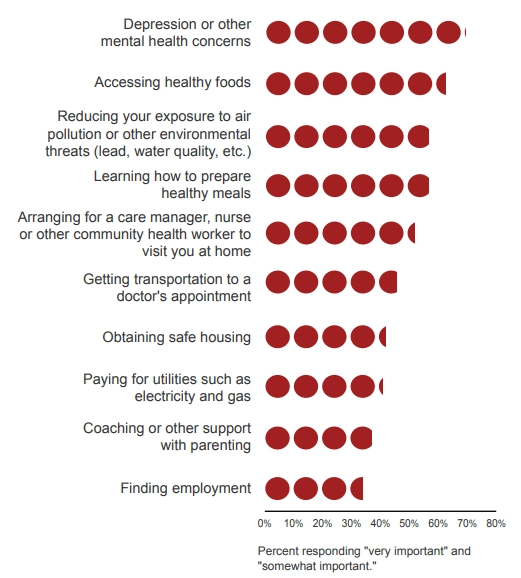

Essentially, SDOH are environmental and social factors that affect people’s well-being: while clinical care takes over one-fifth of the general health of patients, the other 80% seem to belong elsewhere. And, while earlier improving clinical care was a top priority, in 2020 trends will change: for the healthcare industry, it will be essentially important to deliver digital solutions that will address social determinants of health. These comprise transportation, care management at home, healthy food options, accessibility and availability of care, coaching, etc.

Deloitte Center report states that hospitals leaders are determined to create processes to address SDOH — so, consider running the tide. Among health-related social needs, Delloite recognizes housing instability, food insecurity, transportation, education, utility needs, interpersonal violence, family and social support, employment and income. So for digital health startups — and businesses, in general, — will be vital to include social determinants of health when developing their solutions.

3. Interoperability and accessibility across digital healthcare will increase

Telehealth is already among trends in digital healthcare — as, in general, home healthcare market. Home healthcare market includes wearables and other Internet of Things solutions for monitoring, prevention and care management. The rise of SDOHs is kind of reflected in the latter. Home healthcare market includes wearables and other Internet of Things solutions for monitoring, prevention and care management. The rise of SDOHs is kind of reflected in the latter.

The reasons for such drive are simple: from one point, there are more and more senior population that requires care and attention from clinicians and their caretakers.

On the other hand, value-based care and stakeholders’ (we waited for it and here it is) acceptance of the fact digital solutions worth investments, despite the risks, pushed hospitals towards collaboration with telemedicine or virtual care solutions vendors. Accessibility and availability are essential for post-hospital care, chronic conditions, and, in general, understanding of how patients feel when they’re not in the ED. Which is a good thing for patients and the better thing for those who plan to provide virtual communication startups or wearables for them.

The expansion of healthcare services towards rural regions will also be supported by 5G.

Deals between different providers and vendors heated (yes, heated more) the question of data availability and interoperability. While in the USA it continues to be a tough subject due to incredible silos (but we start to tackle it!), Europe continues to push its initiative — eHealth Digital Service Infrastructure — to exchange patient data all over the Union. Right now, for instance, Finnish digital prescriptions are valid in Estonia.

The initiative will continue to expand through European Health Data Space, which will become a great source of data for AI processing and analysis and be controlled by legislation on AI — hopefully, accepted in 2020.

All of that is good news for those who plan to enter the healthcare (or continue to operate in it) through the following trend.

4. AI and data analytics will be utilized more

AI is what will drive personalized healthcare for consumers and precision in diagnosis for healthcare providers. Healthcare will finally start full-scale refusal of treating patients on mythological “average,” — and that will boost personalized digital solutions, in various forms and sizes. Powered with AI, wearables and IoT devices, are already used to recognize dangerous symptoms, to manage health and to understand chronic and complex conditions better. There also will be more non-invasive, mobile solutions for diagnosis.

However, it’s important to note that while AI will find more and more use cases both on patients (personalization) and on providers’ (revenue management) side, the — let’s call it bravado — around its powers will lessen, replaced by a growing number of clinical evidence.

The bottom line for this paragraph is this: AI and analytics will continue to conquer the world, but businesses that won’t do trials and testing will be left behind.

5. The tougher grip on privacy, data integrity and availability will appear

European AI legislation will be another regulation to comply with for startups. Also, we expect a release of the European Union’s Medical Device Regulation (MDR) in May of 2020 — studies show that only 27% of 230 medical devices comply with it. Everyone is pretty scared about it, and if you plan to go onto the European market we recommend to be familiar with it. Challenging time for startupers — even those who’ve received CE Mark under the current Directive for medical device will have to be recertified.

As for America, there are wonderful times as well. There is a countdown to the California Consumer Privacy Act — new legislation will take effect on January, 1 (Happy New Year) and basically it will “give Californians the right to see, delete, and stop the sale of personal information that companies have compiled about them.” Users will also be able to see how their data is classified into groups.

While “scared” is a good verb for describing big companies that will have to do some transformation in order to comply with new legislation (by the way, India too), young startups have a wonderful opportunity to consider reasons behind this “scrutiny” and apply the HIPAA and GDPR safeguards into their product from the start. It’s way cheaper, we promise you.

6. Healthcare consumerism will rise in 2020

And finally, the last digital health market trend of 2020 we’ve chosen to write about. People want to approach healthcare as a shop: they want to buy test kits in the store, choose among different providers according to the price and quality of their services, make an educated decision about what therapy they want to try.

They want to be more in control: 61% of people want to use tech that will help them to collect all health information together in one place. How’s that for a business idea?

That’s why personalization and customer experience are so important: now, when digital healthcare has proven its efficiency, people want its product to be convenient, comfortable to use, affordable, and easy to access. Also, don’t forget about design.

Conclusion - digital health, trends and predictions in 2020

Digital transformation is about one-third of the way to its peak, we suppose. Think about it: recently, Germany passed the law that allows doctors to prescribe apps to patients. At the same time, we can’t help but remind you of two things. First: despite the demand for consumer-facing digital health technology, it’s still important for your startup to conduct market research. Second: if you aren’t ready to comply with regulations and consider them really everywhere, run clinical trials, experiments, and, generally, invest a lot into security safeguards, it’s better to refrain from working with patients’ data.

If you’re ready to go through all this, though, it’s your perfect time.

If you want to receive articles about digital health technologies and market, subscribe to our newsletter.

Tell us about your project

Fill out the form or contact us

Tell us about your project

Thank you

Your submission is received and we will contact you soon

Follow us